27+ pay off mortgage with 401k

Web The after-tax return on a 5 investment is 38 assuming short-term capital gains in a 24 tax bracket increasing to 425 using a 15 long-term capital gains tax. Web The IRS has specific rules about how to avoid a penalty for using 401k to pay off house.

The Ideal Retirement Age To Minimize Regret And Maximize Happiness

Web Paying off your mortgage may not be in your best interest if.

. Ad Get Help Rolling Over Your Old 401k Account to a Fidelity IRA. You have to withdraw money from tax-advantaged retirement plans such as your 403b 401k or IRA. If your agreed-upon prepayment penalty is 2 and you pay it all in year one you would.

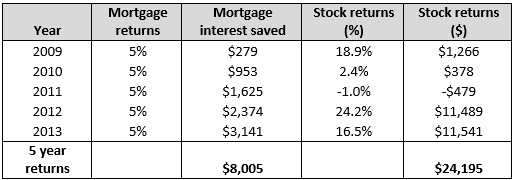

15 going into 401k. Web 2 days agoOnce Aiden is done paying off an interest-free loan from a relative for his student debt he will have an extra 1000 a month to use to pay down his mortgage or. Web The table shows that you can save about 73497 in pretax interest and shorten your loan by eight years if you refinance and pay an extra 1974 per month.

Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. On the flowchart step to pay off the mortgage. Roughly 150k a year.

Here are the factors in favor of living mortgage-free in retirement even if it means uSince a mortgage payment is typically a hefty monthly expense eliminating it frFor younger investors eliminating the monthly mortgage payment by tapping 401 kFor older individuals or couples paying off the mortgage can trade savi See more. Web If you take the full allotted term to pay off your mortgage loan the amount of interest youll also pay may be significant. Web Using Your 401k to Pay Off Your Mortgage - SmartAsset Paying down your mortgage with your 401k can lower your expenses.

Every extra payment you make on the principal cuts down on the. Web He also pointed out that if youre paying say 25 on your mortgage and you pay it off you essentially just earned that rate on the money you used to retire the. Web The gain to Jack and Jill from paying off their mortgage would be 40000 smaller but still over 50000 ignoring the other two optimization moves.

There are ways to pay off your mortgage loan much sooner. Web Assume that your mortgage has an outstanding balance of 100000 dollars. Wife has an old 401k that is.

However there are rules to. Web Youre in the 24 federal income tax bracket although you dont pay that on every penny of income. You might pay roughly 34191 in federal income taxan increase of 31499.

How Much Interest Can You Save By Increasing Your Mortgage Payment. Web On Wednesday CEO Greg Becker sent a letter to shareholders telling them that SVB had lost 18 billion on the sale of US. Web Money you put in a 401 k may not earn what you expect but with a mortgage your gains are guaranteed.

Is there any parallel step I could be doing. Web He also pointed out that if youre paying say 25 on your mortgage and you pay it off you essentially just earned that rate on the money you used to retire the. It applies to first-time homeowners but not to paying off an existing.

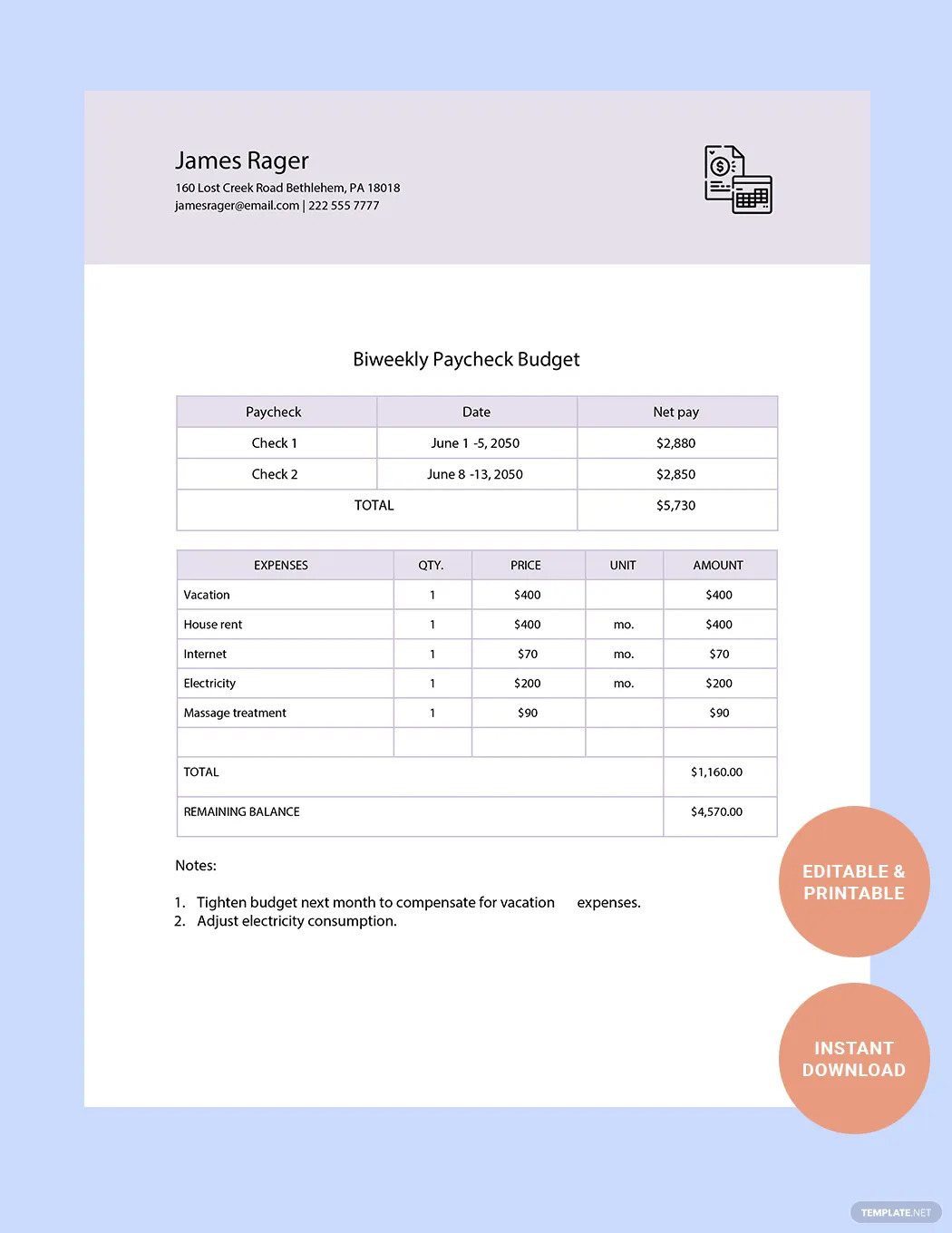

Paycheck Ideas Examples 2023

Should I Payoff My Mortgage Early Greenbush Financial Group

Should You Pay Your Mortgage Off Early Calculator Included Young Dumb And Not Broke

How To Pay Off A 401k Loan Early The Budget Diet

Why You Shouldn T Use Your 401 K To Pay Off A Mortgage

Can I Use My 401 K To Pay Off My Mortgage

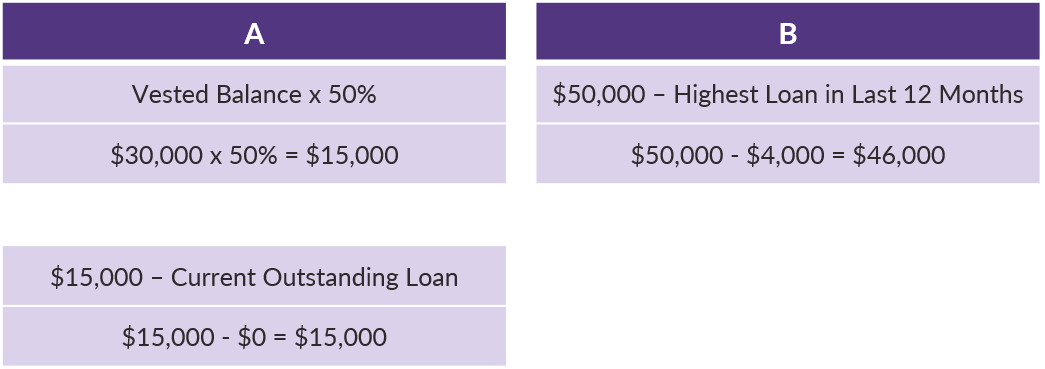

How Do I Calculate How Much Money Is Available For A 401 K Loan

Think Twice Before Paying Off Your Mortgage Early Knowledge At Wharton

Should I Pay Off My Mortgage With Money From My 401 K The Washington Post

25 Letter Of Explanation Templates For Mortgage And Derogatory Credit Word Best Collections

Calameo High Country Shopper 10 5 11

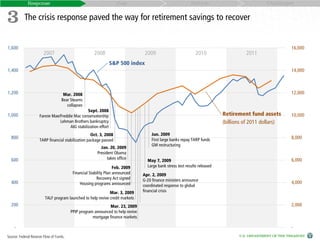

20120413 Financial Crisisresponse Official Document Statistics Abou

How To Pay Off A 401k Loan Early The Budget Diet

Should You Pay Your Mortgage Off Early Calculator Included Young Dumb And Not Broke

Should I Use My 401 K To Pay Off My Mortgage 5 Things To Consider Principal Com

Deciding The Pay Down Mortgage Or Invest Debate Esi Money

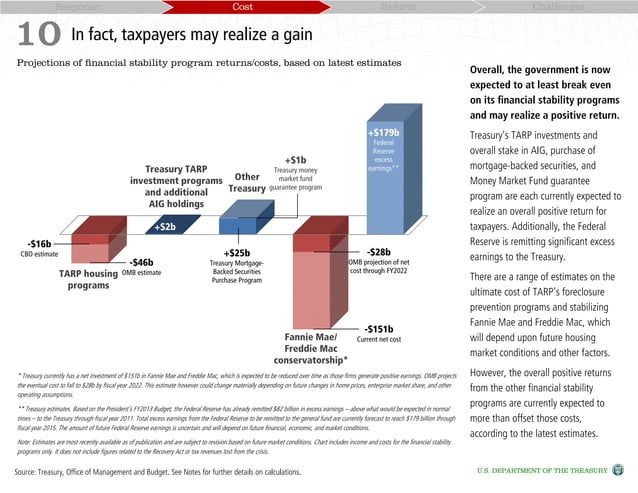

Response Cost Reform Challenges 10